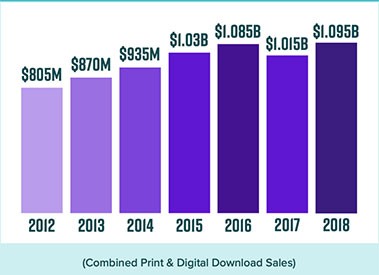

Comics and graphic novel sales hit a new high in 2018, according to a new joint estimate by ICv2’s Milton Griepp and Comichron’s John Jackson Miller. Total comics and graphic novel sales to consumers in the U.S. and Canada were approximately $1.095 billion in 2018, an $80 million increase over sales in 2017. The increase was due to gains in book channel and digital sales, and the inclusion of an estimate for U.S. and Canada sales through crowdfunding sites for the first time.

“After a brief downturn in 2017, the market bounced back last year,” Miller said. “Popular releases helped right the ship in comics shops, even as other sales avenues made significant gains.”

“A historic shift is playing out as the market grew, primarily in the book channel, in 2018,” Griepp said. “While comics stores are still the largest channel, they represented less than half the market for comics and graphic novels in 2018 for the first time in at least three decades.”

Sales in the book channel, which includes chain bookstores, mass merchants, major online retailers, and Scholastic Book Fairs, were up by double digits, with sales of kids graphic novels the biggest factor. Digital sales were also up for the first time in several years, with increased title counts across multiple platforms a factor. Sales in comic stores were down very slightly versus the previous year.

Sales of all three formats, comics, graphic novels, and digital, grew in 2018, with graphic novels leading the way, followed at some distance by digital and comics.

As presented above and in the accompanying infographics, the analysis by Comichron and ICv2 was divided up between periodical comics (what some call “floppies” or “pamphlets”), graphic novels, and digital download-to-own sales. All print figures are calculated based on the full retail price of books sold into the market, and do not account for discounting or markup. Digital sales do not include subscription-based “all you can read” services.

We’ve added a new category, “Other” to our channel breakdown. “Other” includes the Newsstand (periodical sales through specialty retail and mass merchant chains) and Crowdfunding (Kickstarter, etc.) channels. This year, those two channels each accounted for roughly half of the “Other” category.

Sources for the information include NPD BookScan, which collects weekly point-of-sale data on print books from over 16,000 locations including e-tailers, chains, mass merchandisers, independent bookstores, and more. NPD BookScan covers approximately 85% of the U.S. trade print book market. Some publishers classify titles that are primarily text, or art books, as graphic novels; we remove those titles from our analysis.

The analysis also incorporates information released by Diamond Comic Distributors, the largest distributor of English-language comics and graphic novels in the world, on sales to comic stores.

Information is also gathered from a variety of other sources, including publisher, distributor, and retailer interviews.

This is the sixth joint market size analysis from ICv2 and Comichron; the first was for 2013 sales.

Premier Pop C Pop Culture News – Movies, Comics, Television, Books, Toys, Games, and More

Premier Pop C Pop Culture News – Movies, Comics, Television, Books, Toys, Games, and More